How UPI apps make money?

The popularity of UPI (United Payments Interface) apps has surged dynamically in the years since they offer smooth, free-of-cost & hassle-free digital payments.

Did you know UPI processed 7.3 billion transactions in October 2022 alone?

UPI apps offer simplified, & easy contactless payment methods that allow consumers to pay via QR codes or mobile numbers. They can also transfer money, make bill payments, etc., by linking multiple bank accounts into the same application. Neither the merchant nor the consumer has to pay any additional charges while doing so.

That leaves a question then,

How do they actually make money?

Ever wondered how these UPI apps generate their revenue? Since there are no extra charges to the merchant or consumer when they use the UPI app, how do they earn profits?

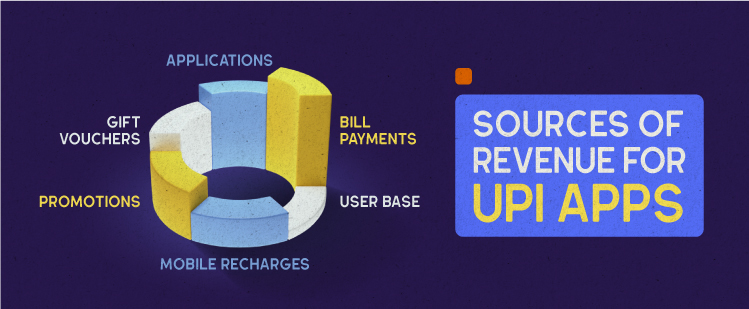

The main reason these apps continue to operate is the opportunity to grow their user base, a commission from service providers, and bill payments made by the users.

Some UPI apps in the market also offer digital gold (such as PhonePe) and get their commissions from partnering for gift vouchers and promotions. So, this is how these UPI apps reap revenue & also use the obtained user base for building new products.

In a nutshell, UPI apps have a unique revenue model that helps them continue running their applications without additional charges.

Let’s dig a little deeper!

When we decide on a granular level, UPI apps generally generate revenue from these few areas. Although the outcomes differ from one app to another in the market, there is also an underlying similarity that benefits all UPI apps.

Opportunity to grow user base

UPI apps are famous for their free-of-cost model. The UPI apps are benefitted from the user data they generate when transactions take place on the application. Of course, neither these apps nor any other companies can access the individual user’s account.

They can only use individual transaction data and analyze their patterns to innovate & develop new products. In the data-driven market, companies obtain this data only to look out for the patterns and understand what is popularly referred to as ‘Customer Behavior’. This user data serves as the key for them to innovate future products.

Generating revenue by commission

Right from bill payments, mobile recharges, and payments to other apps, these UPI apps get a commission from the respective service providers. To be precise, all of these commissions largely depend on the partnerships/ collaborations/ agreements these UPI apps have with other merchant companies, service providers, operators, & other applications.

- Bill payments

The UPI apps will have partnerships/ tie-ups in bill payments with merchant companies. So, whenever the user interacts with the service provider/ company via the UPI app (pays their bill), the UPI app receives the commission from the service provider/company.

- Mobile recharges

UPI apps also generate commissions when the user opts for mobile recharges from any SIM operators in the app. The SIM operator pays the UPI app a commission for every recharge in this scenario.

- Promotions and gift vouchers

UPI apps also gain revenue from numerous promotions & gift vouchers that other companies offer. These UPI apps generate gift vouchers and promotional offers for other applications whenever a user makes transactions. (GPay offers many vouchers from popular brands after the consumer makes a transaction).

While doing so, they can earn their commission from this method, and these sold gift vouchers also add up to the UPI app’s commission. For example, GPay generates scratch cards after every transaction the consumer makes in which they receive promotional coupons/vouchers from companies like Uber, mCaffeine, Kotak Bank, etc.

- Other applications

UPI apps also have commissions from other applications as well when the user makes payment with them. For instance, if a user interacts with any food delivery app, orders, and makes payment via this UPI app, the payment also brings in commission to the UPI app. Also, the sold gift vouchers add up to the UPI app’s commission. (For instance, PhonePe & Dominos have a similar partnership, but this entirely depends upon the strategic partnerships the companies have with each other)

To sum up,

These are the most popular methods by which UPI apps generate revenue and still continue to operate in the competitive landscape. To name a few popular UPI apps that are topping up the list in India include PhonePe, GPay, & Paytm.

PhonePe has 46% share of UPI usage, followed by GPay with 34% and Paytm with 14%. Amazon Pay stands at 1.83% and other TPAPs (Third-Party Application Providers)/banks hold a share a total share of 6%.

And that pretty much shows us that,

Commissions are the major contributor to revenue generation for all the UPI apps in the market!

Got any more queries regarding the fintech landscape? Feel free to join our discussion forum to ask, answer & learn more about fintech!