A quick guide to setting your startup! – All You Need to Know

Over 89,000 thriving startups in less than a decade. And 27,000 active tech startups.

India’s startup scene is booming despite economic speed bumps. Though macroeconomic situations, regulatory headwinds, and valuation challenges caused a reset of sorts, startups are emerging resilient with focus on sustainable business models, innovation, and problem-solving tech capabilities that outshine the conditions.

Our tech startup ecosystem, the third largest in the world, created 1,400 unique, funded tech startups in 2022 alone. Early-stage and seed-stage investments grew by over 20%. And 47% of all investment deals involved a newbie that had already had their first-round funding. Despite challenges, economists, industry veterans, and government initiatives confirm there is a promising future for startups in India.

Starting up?

Kickstarting a business from scratch can be an exciting yet challenging proposition. Even with a well-thought plan and execution strategy in place, startups could still struggle with nailing investments, acquiring customers, hiring/ keeping good employees, and managing compliance. Startups need constant support and resources in training, mentorship, networking, and funding to help them tide over challenges and achieve stability. With the right help, startups can grow, thrive, create job opportunities, and boost the economy.

In this article, we focus on supporting budding entrepreneurs with the requisite understanding of setting up their startups in India. We break down mandatory processes, steps, and legal structures to ease your journey.

So, basics first.

What is a startup?

Any company in its early stages of formation is called a startup. It is usually funded via bootstrapping, angel investors, venture capitalists, or loans. The uncertainties and risk factors associated with funding, scaling, and operations are higher.

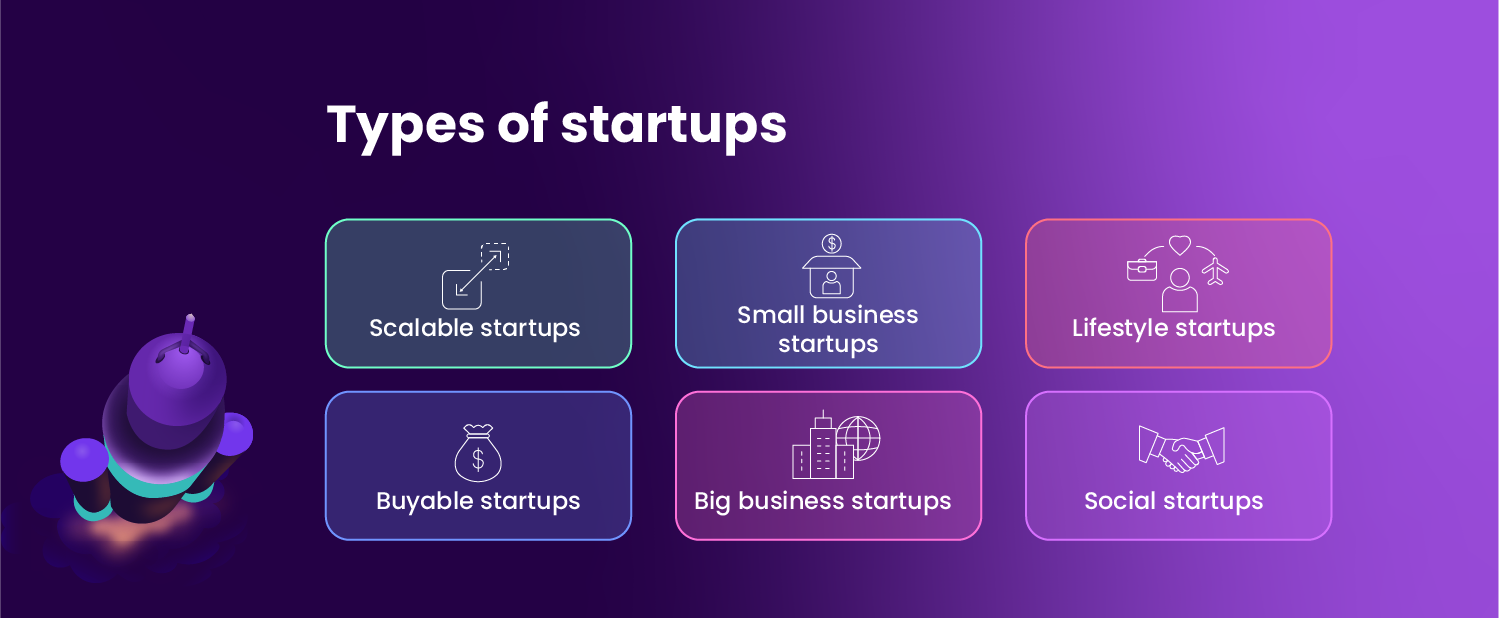

6 Types of startups

Industry veterans classify startups into 6 basic types.

- Scalable startups – Businesses built to expand and scale into international markets fall under this category. A good example could be fintech startups that transcend boundaries and easy money movement across the globe.

- Small business startups –Businesses like grocery stores, cafes, and beauty shops that start small and grow at their own pace.

- Lifestyle startups – Born out of passion, lifestyle startups can involve a range of ideas from fitness, dancing, and travel to even coding.

- Buyable startups – Businesses built to be sold fall under this category. Serial entrepreneurs create these startups to be largely industry-agnostic and tech-focused like mobile app businesses.

- Big business startups – These are typically offshoots of big companies looking to adapt, diversify, expand, and scale with evolving business models.

- Social startups – Build to create a positive impact in society, social startups are not profit focused.

Irrespective of the kind of startup you build, you need to incorporate the business to get your show on the road.

What is Startup Incorporation?

Startup incorporation is a term that refers to registering the startup with a state. The process makes the company a legally recognized entity, separate from its founders or owners. This separation is crucial as it safeguards the personal assets of business owners from debts and liabilities. Incorporation enables startups to acquire assets, raise funds from investors, build credibility with customers and vendors, and even scale into a public company. Incorporating the startup is a mandatory step for all entrepreneurs.

In the Union Budget 2023, the Government has granted an extension of the incorporation date by one year (31 March 2024) for eligible startups to avail tax benefits. The duration for carrying forward and setting off losses has also increased from 7 to 10 years.

Before getting into the steps involved in incorporation, let’s understand the type of legal business structures in startups.

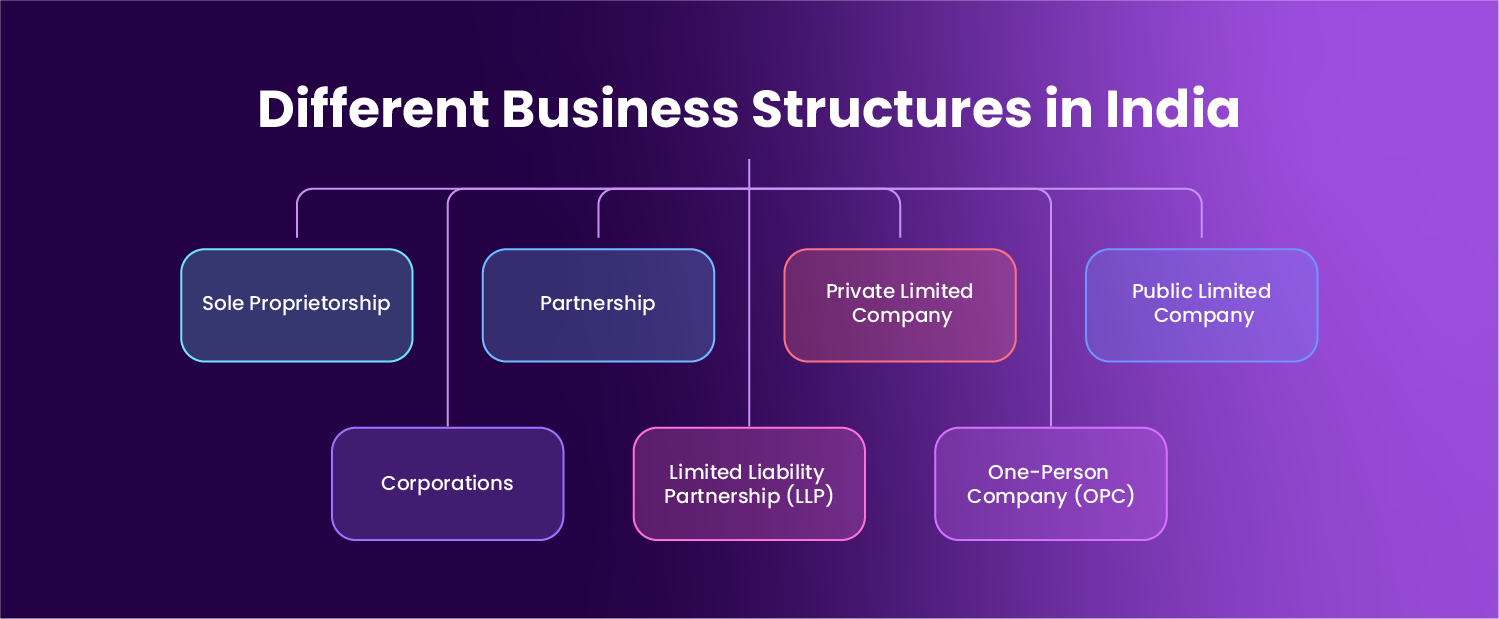

Legal Business Structures for Startups

The success and expansion of a business in India can be significantly impacted by the choice of a business structure. Given the range of options, it’s crucial to think about the legal and practical implications of each type. Some of the common business structures for start-ups in India include the following.

Sole Proprietorship

Sole proprietorship is a structure where the business is owned and run by a single individual. The owner is responsible for all the debts and obligations of the business. It needs minimal paperwork and legal formalities to set up.

Partnership

When two or more people share ownership of a single business, it falls under the partnership structure. As partners, they share the profits and losses and are liable for all the debts and obligations.

Private Limited Company

When a group of individuals (aka shareholders) own the business, it is known as a private limited company. The structure requires a minimum paid-up share capital, limits the transfer of shares, limits the number of partners to 200, and restricts public subscriptions for its securities as per its articles.

Public Limited Company

A public limited company is a type of business entity that offers shares to the public and has limited liability. Its shares can be acquired by anyone through an Initial public offering (IPO) or by trading on the stock market. In this structure, ownership is not limited to a specific group of people, unlike private limited companies.

Corporations

Corporations are legal entities that shareholders own. They exist independently from individuals who own or manage them. They have their own legal rights and responsibilities separate from those of its owners.

Limited Liability Partnership (LLP)

An LLP is a unique business structure that takes certain elements from both corporations and partnerships. In this type of business, partners are not held personally liable for the actions of their partners or the business itself.

One-Person Company (OPC)

The One-Person business structure is a private limited business with a single shareholder. Despite its limitations, the OPC is still a reasonable choice for individual entrepreneurs seeking to establish a larger business than a proprietorship.

The table below lists the benefits and limitations of each type of legal structure.

Benefits and Limitations of Legal Structures

How to Choose the Right Legal Structure

If you want to protect your startup from risks, not overpay taxes, and be less liable, more sustainable, and profitable, you must choose the right structure.

How can you select the right structure?

Brainstorm on the factors below and decide which structure would be ideal for your startup.

- Protection for personal assets: Choose a structure that keeps your finances separate from your business debts and liabilities.

- Tax implications: Make sure you understand the tax implication of your chosen structure including tax liability and obligations.

- Ownership and control: Decide how ownership and control will be divided among stakeholders including partners and shareholders.

- Funding options: Consider the types of funding you want to pursue and choose a structure that supports those goals.

- Administrative ease: Some structures can be more complex to set up and maintain, so be mindful of the resources and time you have available.

- Flexibility for growth: Your business will change and grow over time, so choose a structure that allows for that growth and evolution.

Remember, it is imperative to obtain professional guidance while deciding on the appropriate legal structure for your startup.

Now, let’s come back to the startup incorporation process.

What are the steps involved in incorporating a start-up?

5 Steps to setting up a startup in India!

Incorporating a startup involves several steps. It is essential to follow them in the right order to ensure an error-free, smooth process.

- Step 1: Choose the right legal structure

The incorporation process begins with choosing a suitable legal structure. We’ve discussed this in the sections above. Remember to procure a certificate of incorporation or a partnership deed, obtain a Permanent Account Number, and meet other prerequisites for incorporation. You can incorporate a Private Limited Company or a Limited Liability Partnership (LLP) through the Registrar of Companies (ROC). This process involves submitting the necessary documents and fees along with the registration application. The Registrar of Companies (ROC) issues an incorporation certificate that serves as definitive proof of the company’s existence. Having professional support here will be of immense help.

SPICE+ is an initiative by MOC (Ministry of Corporation) Affairs in India to file various forms and applications required for incorporation and apply for licenses and registration specific to your start-up or business. This streamlined process not only saves time and money but also supports the growth and success of your startup.

The next step is to fill out the required forms and complete the registration process to initiate the incorporation process.

- Step 2: Register with Startup India

Register your business as a startup under the startup India initiative. The Startup India program is our government’s initiative to support and boost the start-up ecosystem in India. An entrepreneur can enjoy the following benefits from the program.

- Relaxed norms

- Increased networking opportunities

- Cost reduction

- Tax exemptions

- Access to funding

- Easy exit options

- Cheaper patent costs

Simply fill out the form available on the Startup India website. Provide all necessary information and upload the required documents for successful Startup India profile creation. You can also visit Invest India to get support in funding and investments.to get support in funding and investments.

- Step 3: Apply for DPIIT recognition

The next step is to apply for Department for Promotion of Industry and Internal Trade (DPIIT) recognition to reap the benefits of the Startup India initiative. To get this DPIIT Recognition, log in to your Startup India account, go to the Schemes and Policies tab, and click the DPIIT Recognition for Startups button.

Fill out the Startup Recognition form with the business details, office address, representative information, director/partner details, and startup activities. Accept the terms and conditions and submit the form.

- Step 4: Submit relevant documents

Ensure you have the following docs handy for the submission.

- Incorporation/Registration certificate

- Proof of funding (if any)

- Authorization letter of the authorized representative

- Proof of concept (such as pitch deck, website link, or video)

- Trademark and patent details (if applicable)

- List of awards or recognition certificates

- PAN number

These documents help the government understand the credibility and authenticity of your business.

- Step 5: Obtain Recognition Number

After submitting your application and all necessary documents, you will receive a recognition number for your startup. The certificate of recognition will typically be issued within 2 days of submitting the information online, once all your documents have been reviewed.

By following these steps, you can legally establish your startup and begin operating as a formal business entity. It is essential to take note of the compliance requirements and deadlines to avoid any penalties or delays.

Tips for Start-ups

Before we wrap up the article, let’s conclude with some potent tips to help set you up for success.

- Conduct extensive research and make informed decisions

- Determine the ideal structure for your business

- Choose the perfect location for company operations

- Incorporate your startup and keep the required documents handy

- Project confidence and be concise when seeking funding

- Seek support and advice from a trusted incubator or network

- Hire a team with a positive attitude and diverse skill sets

- Choose the right product and marketing approach for the target audience

- Stay compliant and avoid regulatory headaches

- Invest in building a strong brand image

- Explore and make the most of partnership opportunities

Speaking of beneficial partnerships, you can collaborate with Tether, our strong community for fintech entrepreneurs and startups. You can connect and reach out to fellow fintech peers through our forum.

Now, you are ready.

Go ahead and grab the world by its horns.

If you found this article useful, share it with fellow entrepreneurs, startup enthusiasts, and aspirants you know! Join the #TetherCommunity today and be a part of India’s booming fintech revolution!