Central Bank Digital Currency 360: In-Depth Guide

Central Bank Digital Currency is a significant milestone in the evolution of fintech and payments. It holds profound political, social, and economic implications for the global community.

114 countries holding more than 95% of the world’s GDP are actively exploring the benefits of Central Bank Digital Currency (CBDC). 11 countries, including the Bahamas, Nigeria, Jamaica, and a few other Caribbean nations, have already launched their CBDCs. More than for capacity development, customized advisory services, and surveillance synergies. By 2030, the value of CBDC payments is expected to reach $213 billion annually.

In India, the Reserve Bank floated the e-Rupee pilot in 2022 in two versions: CBDC-Wholesale (CBDC-W) and CBDC-Retail (CBDC-R). Select financial institutions have restricted access to the Wholesale e-Rupee, and the Retail e-Rupee is intended to be used by all non-financial consumers and businesses. The use case for the Wholesale e-Rupee pilot is the secondary market transaction settlement of government securities (G-secs). The Retail e-Rupee is intended for customer transactions through a digital wallet (Android compatible) offered by the participating banks in the pilot program. Today, the Reserve Bank of India (RBI) wants to expand the ongoing pilot to FY24 to incorporate more locations, participating banks, use cases, and features.

With so much action happening on the CBDC front, it is important that you get a 360-degree view of this government-backed digital currency to stay ahead of the curve.

In this article, we guide you through the intricacies of CBDCs, their advantages, disadvantages, and potential impact on the global financial landscape.

So, buckle up and get ready to dive into the world of CBDC!

What is a Central Bank Digital Currency?

A Central Bank Digital Currency is a form of fiat currency issued and regulated by a country’s central bank. It is a high-security instrument and a digital equivalent of traditional physical currencies that can be used alongside existing forms of money. It provides a secure and efficient means of conducting transactions and facilitating financial inclusion.

For example, e-Rupee is India’s CBDC and is the digital equivalent of the sovereign Indian rupee. It is convertible to paper currency without changing in value. The e-Rupee will appear on the RBI’s balance sheet as a means to build trust, safety, liquidity, settlement finality, and integrity.

Why do central banks issue digital currencies?

Central banks across the globe are exploring CBDC issuance at different stages. Some of them are in the research phase, while others are in the Proof of Concept (POC) or pilot stage. And a handful of them have already launched central bank-backed digital currencies.

Are you wondering why there is so much traction around CBDCs?

Here are common reasons why the global central banking community and governments want to launch digital currencies.

- Encourage the growing digital economy

- Reduce the cost of transactions and physical cash management

- Create an efficient monetary payment system

- Promote financial inclusion

- Introduce competition and resilience in the domestic payments market

- Increase efficiency in payments

- Create programmable money and improve transparency

- Enable the seamless flow of monetary and fiscal policies

How are CBDCs different from Cryptocurrencies?

CBDCs are distinctively different from cryptocurrencies like Bitcoin. They are backed by a central authority and have legal tender status. Thus, CBDCs are more secure and stable when compared to decentralized cryptocurrencies, which come with inherent volatility and potential security risks.

Principles & Policy frameworks of CBDC

The regulatory framework for CBDCs is still being developed, but there are a number of principles that are emerging. These principles include that CBDCs should be as follows.

- Issued by the central bank and be a direct liability of the central bank. This will ensure that CBDCs are backed by the full faith and credit of the government.

- Accessible to all citizens and residents by promoting financial inclusion and reduce the reliance on cash.

- Subject to the same AML/CFT regulations as other financial products and prevent CBDCs from being used for illegal activities.

- Compatible with existing payment systems, making it easier for people to use CBDCs for everyday transactions.

CBDCs face the same regulatory compliance requirements as all other fiat currencies. This includes anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as consumer protection laws.

The impact of CBDC on monetary policy implementation is a complex issue that is still being debated by economists and central bankers. There are a number of potential channels through which CBDC could affect monetary policy, including:

Money velocity: CBDC could lead to an increase in money velocity, as people hold less cash and more CBDC in their digital wallets. This could make it more difficult for central banks to control the money supply and interest rates.

Bank deposit disintermediation: If people switch from holding bank deposits to CBDC, this could lead to a decline in bank lending and a contraction in the money supply. This could make it more difficult for central banks to stimulate the economy.

Volatility of bank reserves: CBDC could lead to more volatility in bank reserves, as people move their CBDC holdings between different institutions. This could make it more difficult for central banks to implement monetary policy smoothly.

Currency substitution: If CBDC becomes widely adopted, it could lead to currency substitution, as people switch from holding foreign currency to CBDC. This could make it more difficult for central banks to manage their exchange rates.

The impact of CBDC on monetary policy implementation will depend on a number of factors, including the design of CBDC, the level of adoption, and the overall state of the economy. However, it is clear that CBDC could have a significant impact on the way that monetary policy is implemented.

Advantages of CBDC

- Promotes financial inclusion and economic growth

One of the key advantages of implementing a CBDC is the potential for increased financial inclusion. By providing an easily accessible digital alternative to traditional cash, CBDCs help bring banking services to unbanked and underbanked populations. CBDCs play a crucial role in reducing income inequality through the targeted distribution of social welfare programs. The transparency and traceability of CBDC transactions make it easy for the government to monitor if the funds have reached the intended beneficiary. This way, CBDC can promote economic growth in developing countries.

- Cost-effective cross-border payments

Another significant advantage of CBDCs is their potential to drive efficiencies in cross-border payments. Cross-border transactions can get complicated due to various factors, such as differing regulations, standards, and technical infrastructures. By leveraging blockchain technology and a universally accepted digital currency, CBDCs help streamline the process, reduce the costs associated with cross-border transactions, and make it easier for people to access financial services.

- Increased security

As with any digital currency, security is a crucial concern for CBDCs. Ensuring the integrity of transactions and protecting user data is paramount, and central banks must invest in robust security measures to prevent cyberattacks and data breaches. One way in which CBDCs can address security concerns is by employing blockchain technology, which offers a decentralized and secure method of recording transactions. Blockchain provides increased transparency and traceability, making it more difficult for fraudsters to engage in illicit activities such as money laundering or terror financing.

- Impact on cash

CBDCs will not disrupt or undermine the existing cash infrastructure in the near future. It will be designed carefully considering the potential impact of a CBDC on financial inclusion. One reason is that cash is still widely used by people in many countries, and another is that cash can be used by people who do not have access to other forms of payment, such as those who live in rural areas or who are unbanked.

However, there are also a number of potential benefits to using a CBDC. It offers more advantages over cash, such as convenience, speed, and security. This might even lead to a possibility of reduction in the use of cash. As a result, people may be more likely to use CBDCs for everyday transactions, such as buying groceries or paying for a taxi. CBDCs could lead to a decline in the use of cash in certain areas, such as retail transactions. However, cash is still widely used in many parts of the world for a variety of reasons, such as for informal transactions, for payments to unbanked individuals, and for payments in areas with poor internet connectivity. As a result, it is unlikely that CBDCs will completely replace cash. Hence, nothing can be predicted now.

Disadvantages of CBDCs

As with any new technology that comes in, there are a few potential disadvantages too.

- Increased surveillance

CBDCs could lead to increased surveillance of financial transactions, as all transactions are digital and would be recorded by the central bank. This could raise privacy concerns and lead to a loss of personal freedom, as it could enable governments to monitor individual spending habits and potentially restrict certain purchases. Restricting savings and spending is possible when the central bank sets limits on how much money people can hold in CBDC accounts or how much money they can spend in a certain period of time. This could be used to control inflation or discourage people from engaging in certain activities, such as gambling or drug trafficking.

- Disintermediation of commercial banks

CBDCs could lead to the disintermediation of commercial banks. This happens when people and businesses bypass banks and deposit their money directly with the central bank. This could reduce the amount of lending that banks do, which could even slow economic growth and lead to job losses.

- Potential for cyberattacks

As CBDCs are entirely digital, they are vulnerable to hacking and cyberattacks. If a central bank’s CBDC system were to be hacked, it could result in significant financial losses for individuals and institutions. Also, as it is difficult to monitor and regulate compared to physical cash, this will eventually lead to more challenges in preventing money laundering and terrorism financing. However, it is essential to strike a balance between security and privacy, as increased transparency can also lead to concerns about user data being accessed or exploited by central banks or other third parties.

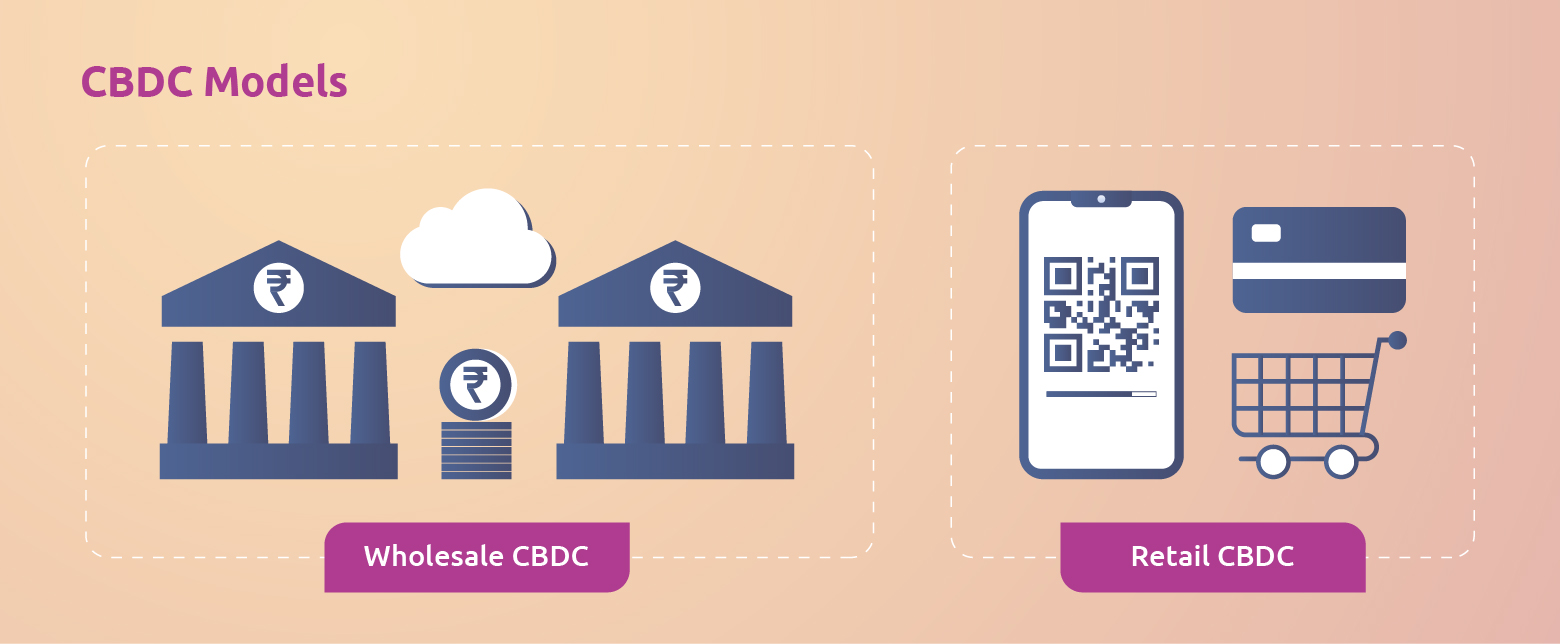

CBDC models

There are two primary models being considered for the implementation of Central Bank Digital Currencies: Wholesale and Retail.

- Wholesale CBDC model

In the wholesale model, CBDCs are primarily utilized by financial institutions, such as banks, for payment and settlement transactions. It is not intended for use by the general public. The model aims to improve the efficiency of existing wholesale financial systems by streamlining processes such as interbank transactions and asset transfers between banks. Wholesale CBDCs could potentially simplify complex cross-border transactions as well as reduce the risks associated with counterparty transactions.

One of the key benefits of wholesale CBDC is that it can help reduce the risk of fraud and financial crimes. This is because the transactions are conducted digitally and are recorded on a blockchain or other distributed ledger, making it much more difficult for fraudsters to manipulate or falsify the data.

Wholesale CBDCs can be used to settle large-value payments, such as interbank transfers and securities transactions. They provide liquidity to financial markets and help streamline the settlement process for financial institutions. Because the transactions are conducted digitally, they can be settled much more quickly and efficiently than traditional paper-based transactions.

Overall, wholesale CBDC is an exciting development in the world of digital currencies and has the potential to revolutionize the way that financial institutions conduct transactions and settle accounts.

- Retail CBDC model

The retail model of CBDCs focuses on providing individuals and businesses with a digital equivalent of physical cash. Retail CBDCs can be used to make payments, store value, and access financial services. This model aims to make financial services more accessible to those without access to private banking facilities as well as reduce the costs associated with managing physical cash.

Retail CBDCs can come in two forms:

- Account-based access – Here, transactions are approved based on user identity verification, with the central bank processing the transaction and transferring funds between accounts.

- Token-based access – In this model, transactions are established through public-private key pairs and digital signatures, offering a higher level of privacy at the potential risk of losing access to funds if a user forgets their private key.

When designing a retail CBDC, central banks must consider various architectural elements, such as the legal framework of claims and payments operations, as well as the balance between central bank and private sector involvement.

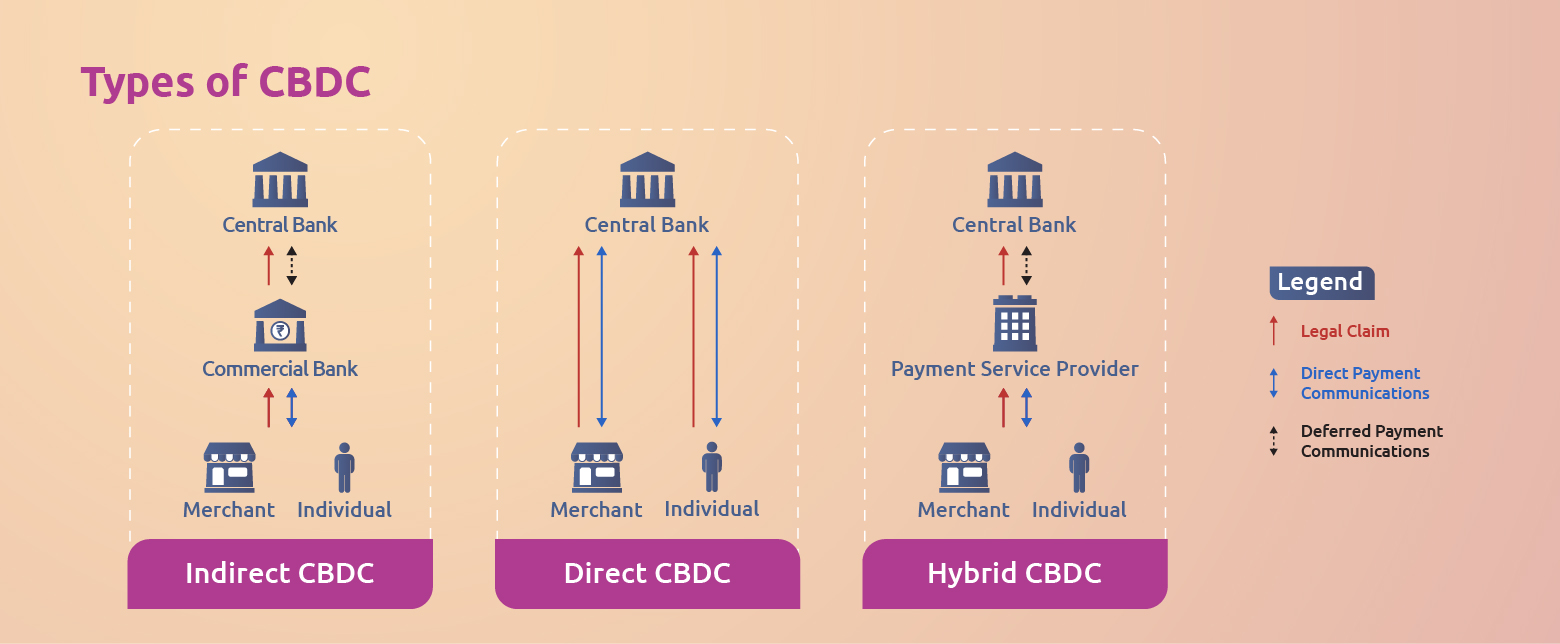

There are three primary retail CBDC architectures being explored: direct, indirect, and hybrid.

- Direct (1-tier) model

In the direct model, end-users hold accounts directly with the central bank, eliminating the need for intermediaries such as commercial banks. This approach gives all users, from community banks to informal gig workers, access to central bank services.

- Indirect (2-tier) model

The indirect model involves commercial banks acting as intermediaries between the central bank and end-users. In this approach, CBDC claims are backed by the central bank but held by commercial banks, which are responsible for onboarding customers and managing retail payments.

- Hybrid model

The hybrid CBDC model combines elements of both direct and indirect architectures, allowing for direct claims on central banks while also involving the private sector. This approach enables financial institutions to separate CBDCs from their balance sheets, enhancing portability and reducing the risks associated with single points of failure. The hybrid model is considered the most realistic CBDC model, offering a balance between the advantages of direct and indirect approaches while minimizing potential drawbacks.

CBDC implementation around the world

As we already discussed, CBDC implementations are underway across the globe. With the Bahamas (Sand Dollar), Nigeria (e-Naira), Jamaica (Jam-Dex), and a few other Caribbean nations leading the way, the developed world is waking up to its advantages.

Here’s where some of the leading nations are in their CBDC journey.

China

China is one of the most advanced countries in terms of CBDC implementation. The People’s Bank of China (PBOC) has been working on its digital currency, the Digital Currency Electronic Payment (DCEP), for several years. As of January 2023, the DCEP represented 0.13 percent of the cash and reserves held by the central bank. Though it looks like a small percentage, it is a significant increase from the 0.05% that the DCEP represented in December 2022. The PBOC has said that it plans to increase the circulation of the DCEP in the coming months and years.

Sweden

Sweden is another country that is exploring the potential of CBDCs, with the Riksbank (Sweden’s central bank) having launched a pilot program for its digital currency, the e-krona. The e-krona is intended to provide a secure and efficient alternative to traditional payment methods and is currently being tested in a limited number of scenarios.

The Bahamas

The Bahamas launched the world’s first nationwide CBDC. The Central Bank of The Bahamas launched its digital currency, the Sand Dollar, in October 2020. The Sand Dollar is intended to provide a secure and efficient way for people to make payments and conduct transactions, particularly in remote areas where traditional banking services may not be available.

The UAE

The Central Bank of the United Arab Emirates (CBUAE) has announced its plans to launch a digital currency by 2026. It expects to complete the first phase of its central bank digital currency strategy around mid-2024, which includes proof-of-concept work for a wholesale and retail CBDC.

The CBDC is expected to address the challenges of domestic and cross-border payments, enhance financial inclusion, and promote a cashless society. It will also help to strengthen the UAE’s payment infrastructure by adding more robust payment channels and ensuring a resilient and reliable financial system.

Saudi Arabia

The Saudi Central Bank (SAMA) is currently in the process of experimenting with and implementing a CBDC. The project is still in the early stages, but SAMA has already completed a proof of concept with the Central Bank of the United Arab Emirates (CBUAE). The POC showed that a CBDC could be used to facilitate cross-border payments between the two countries.

SAMA is now working on a second POC, which will focus on domestic wholesale CBDC use cases. This POC will involve the collaboration of local banks and fintechs. The goal of the second POC is to test the economic impact of implementing a CBDC, as well as market readiness and the potential for fast applications of a CBDC-based payment solution.

Singapore

The Monetary Authority of Singapore (MAS) is also actively exploring the implementation of a retail CBDC. MAS has been conducting research and development on CBDCs since 2017. In 2021, it launched Project Orchid, a multi-year initiative to explore the design, technology, and potential use cases for a retail CBDC in Singapore.

Retail CBDCs in Singapore would likely be facilitated through a public-private partnership, with the MAS issuing the digital Singapore dollar and the private sector handling distribution and customer-facing activities.

The MAS has already completed the first phase of its CBDC project. The country has launched an initiative called Ubin+ to strengthen its capabilities in digital currency-based infrastructure for cross-border transactions. Ubin+ will focus on studying business models and technical standards, developing infrastructure to support cross-border connectivity and atomic settlement of currency transactions, and establishing policy guidelines for connectivity across borders.

European Union

The European Union is currently exploring the potential of CBDCs, with the European Central Bank (ECB) having launched a public consultation on the topic in 2020. The ECB is considering a range of options for a potential digital euro, including both wholesale and retail models.

Other countries, such as Uruguay, Ukraine, Russia, South Africa, and India, are in various stages of research, development, and pilot testing for their own CBDCs. Overall, CBDC implementation is an exciting area of development, with many countries around the world exploring the potential benefits of digital currencies.

Future developments in the field of CBDCs

As more countries explore the potential benefits and challenges of implementing Central Bank Digital Currencies, it is expected that we will see further advancements and innovations in this field.

Some potential future developments include:

- Greater interoperability between different CBDCs, allowing for seamless cross-border transactions and reducing reliance on traditional correspondent banking networks.

- The integration of CBDCs with other emerging technologies, such as artificial intelligence, machine learning, and the Internet of Things, to further enhance financial services and enable new use cases.

- Increased collaboration between central banks, governments, and private sector partners to develop and implement CBDCs that address the unique needs and challenges of each country.

Shaping the financial future

Central Bank Digital Currencies present a promising opportunity to revolutionize the global financial landscape, offering potential benefits such as increased financial inclusion, improved cross-border payments, and enhanced security. However, the implementation of CBDCs also presents significant challenges, including potential risks to privacy, cybersecurity, and financial stability.

As more countries continue to explore the potential of CBDCs, it will be crucial to learn from the experiences of early adopters and address the various risks associated with digital currencies. By doing so, we can work towards a more inclusive and efficient global financial system that harnesses the power of digital innovation to drive economic growth and prosperity for all.

Found this interesting?

You can get insights and discuss among peers on fintech topics that pique your curiosity on Tether Community’s New Age Fintech Forum. Sign up now!

Don’t miss out on the valuable insights and informative blogs from us in the future.

Keep reading and stay ahead of the game!